1. Introduction: The Symbiotic Rise of the Gig Economy and Fintech

The world of work is undergoing a seismic shift. The traditional nine-to-five, once the bedrock of employment, is increasingly being complemented, and in some cases replaced, by a more fluid, independent, and project-based approach: the gig economy. Simultaneously, the financial services sector is experiencing its own revolution, driven by technological innovation collectively known as fintech. These two transformative forces are not evolving in isolation; rather, they are increasingly intertwined, with fintech playing a pivotal role in empowering the rapidly expanding global gig workforce. This article explores the critical symbiosis between the gig economy and fintech, examining how innovative financial solutions are addressing the unique needs and challenges faced by flexible workers, particularly within the dynamic markets of the United Kingdom (UK) and India.

1.1. Defining the Modern Gig Economy: Scope, Scale, and Growth Drivers

The gig economy encompasses a wide spectrum of work arrangements, from freelance creatives and consultants to ride-sharing drivers and delivery personnel. Its defining characteristic is the prevalence of short-term contracts or freelance work as opposed to permanent jobs. This model offers unprecedented flexibility for workers and allows businesses to tap into a diverse talent pool on demand. The growth of the gig economy has been fueled by several factors, including rapid advancements in digital platforms that seamlessly connect workers with tasks, a cultural shift towards greater work-life autonomy, and, in some instances, economic necessity.

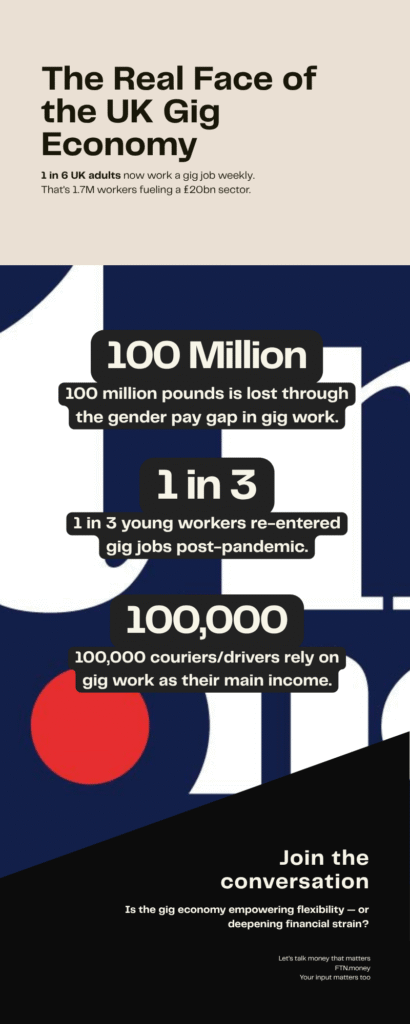

Globally, the gig economy is a significant and expanding phenomenon. In the United Kingdom, the gig economy workforce is estimated to be around 1.7 million workers, contributing approximately £20 billion annually to the economy, a figure comparable to the aerospace industry (StandOut CV, 2024). Many of these individuals, nearly half (48%), engage in gig work alongside full-time employment, highlighting its role as both a primary income source and a means of supplementing earnings.

In India, the gig economy is experiencing an even more explosive growth trajectory. NITI Aayog’s 2022 report, “India’s Booming Gig and Platform Economy,” estimated that 7.7 million workers were engaged in the gig economy in 2020-21, with projections indicating this number could swell to 23.5 million by 2029-30. The report further anticipates that gig workers will constitute 6.7% of the non-agricultural workforce or 4.1% of the total livelihood in India by 2029-30. This surge is driven by India’s vast young population, increasing smartphone penetration, widespread adoption of digital payments like the Unified Payments Interface (UPI), and government initiatives promoting digitalisation and entrepreneurship.

1.2. The Fintech Revolution: Reshaping Financial Services

Parallel to the rise of the gig economy, fintech – the application of technology to improve and automate the delivery and use of financial services – has been fundamentally reshaping how individuals and businesses manage their finances. From mobile payment apps and digital-only banks to sophisticated investment platforms and AI-driven financial advisors, fintech innovations are making financial services more accessible, efficient, and user-centric. Key areas of fintech impact include digital payments, lending, insurance (Insurtech), wealth management (Wealthtech), and regulatory technology (Regtech).

1.3. Thesis Statement: The Critical Role of Fintech in Empowering the Gig Workforce

The unique characteristics of gig work – variable income streams, lack of traditional employment benefits, and complex administrative burdens – present a distinct set of financial challenges that traditional banking systems have often struggled to adequately address. This is where fintech steps in. The critical role of fintech is to develop and deliver tailored financial solutions that cater specifically to the nuanced needs of the burgeoning gig workforce, thereby fostering greater financial stability, inclusion, and empowerment. By leveraging technology, alternative data sources, and innovative business models, fintech companies are creating a new financial ecosystem designed for the flexibility and dynamism of the gig economy. This article will delve into these challenges, explore the innovative fintech solutions emerging in response, examine specific case studies and regulatory contexts in the UK and India, and look towards the future trends shaping this vital intersection of work and finance.

2. The Financial Tightrope: Unique Challenges Faced by Gig Economy Workers

While the gig economy offers undeniable benefits in terms of flexibility and autonomy, it also presents a unique array of financial hurdles for its participants. These challenges often stem from the very nature of gig work – its inherent unpredictability and the departure from traditional employment structures. Understanding these pain points is crucial for fintech innovators and finance professionals seeking to develop effective solutions.

2.1. Income Volatility and Irregularity: The Feast-or-Famine Cycle

Perhaps the most defining financial characteristic of gig work is income volatility. Unlike salaried employees who receive a fixed income at regular intervals, gig workers often experience fluctuating earnings. Demand for their services can vary significantly based on seasonality, market trends, platform algorithms, or even unforeseen events. This “feast-or-famine” cycle makes consistent budgeting, saving for future goals (like a down payment or retirement), and long-term financial planning exceptionally difficult. The lack of a predictable income stream can lead to significant financial stress and anxiety, as workers may struggle to cover essential expenses during lean periods (Finextra, 2024; Elinext, 2024).

2.2. Access to Traditional Financial Products: Credit, Loans, Mortgages

Gig workers frequently encounter barriers when trying to access traditional financial products such as loans, credit cards, and mortgages. Conventional financial institutions heavily rely on stable employment history and regular income statements to assess creditworthiness. The variable income and often short-term contractual nature of gig work do not fit neatly into these traditional risk assessment models. As a result, gig workers are often perceived as higher risk, leading to higher rejection rates or less favourable terms, even if their overall annual income is substantial (Elinext, 2024). The Rollee report, “The Gig Economy Equality Gap,” found that approximately 70% of gig workers face challenges in obtaining such financial products, with many experiencing loan denials despite good credit scores (Elinext, 2024).

2.3. Benefits Gap: Lack of Employer-Sponsored Health Insurance, Retirement Plans, Paid Leave

Independent contractors, who form the bulk of the gig economy, typically do not receive employer-sponsored benefits like health insurance, retirement contributions (pensions), paid sick leave, or holiday pay. This “benefits gap” places the full responsibility and financial burden of securing these essential safety nets squarely on the shoulders of the gig worker. The cost of private health insurance can be prohibitive, and saving for retirement without employer matching contributions is a significant challenge. This lack of a safety net can exacerbate financial insecurity, particularly in times of illness or economic downturn (Finextra, 2024; Elinext, 2024). For instance, a Legal & General U.S. Gig Economy study highlighted that 23% of interviewed freelancers had no health insurance, and access to affordable healthcare and pensions were cited as major factors for considering a return to traditional employment (Elinext, 2024).

2.4. Complex Tax Management and Financial Administration

Navigating the complexities of tax obligations is another significant hurdle for gig workers. As self-employed individuals, they are responsible for tracking income from potentially multiple platforms or clients, managing business expenses, calculating, and paying estimated income taxes (and self-employment taxes where applicable) throughout the year. This is a stark contrast to traditional employees, whose taxes are typically withheld at source by their employers. The administrative burden can be overwhelming, time-consuming, and prone to errors, potentially leading to penalties if not managed correctly. Many gig workers may lack the financial literacy or resources to handle these complexities effectively, often requiring them to seek costly professional advice (Finextra, 2024; Elinext, 2024).

2.5. Delayed Payments and Cash Flow Issues

While some gig platforms offer instant or frequent payouts, others may have longer payment cycles, leading to cash flow challenges for workers who need timely access to their earnings to cover immediate expenses. Delays in receiving payments can disrupt budgeting and force workers to rely on expensive short-term credit options. This issue is particularly acute for those living paycheck-to-paycheck, a common scenario for many in the gig economy due to income volatility (Berkeley Payment Solutions, 2025).

Addressing these multifaceted challenges requires a new paradigm of financial services – one that is agile, data-driven, and deeply attuned to the realities of the gig work lifestyle. Fintech companies are uniquely positioned to fill this void, offering innovative solutions that traditional institutions have been slower to adopt.

3. Fintech to the Rescue: Innovative Solutions for a Flexible Workforce

The financial predicaments faced by gig economy workers have not gone unnoticed. A new wave of fintech companies, unencumbered by legacy systems and traditional thinking, is stepping up to the plate, armed with technology and a deep understanding of the gig worker’s unique financial DNA. These innovators are developing a diverse range of solutions designed to smooth out income volatility, improve access to financial products, bridge the benefits gap, simplify administration, and enhance overall financial well-being for this flexible workforce.

3.1. Enabling Financial Inclusion through Technology: Overview of How Fintech Bridges Gaps

At its core, fintech’s intervention in the gig economy is about fostering greater financial inclusion. Traditional financial institutions have often underserved or excluded gig workers due to risk assessment models that prioritise stable, long-term employment. Fintechs, however, leverage technology – including advanced data analytics, artificial intelligence (AI), machine learning (ML), and mobile-first platforms – to create more nuanced and inclusive financial products and services. They can analyse a broader set of data points, beyond just traditional credit scores, to understand a gig worker’s financial health and earning potential, thereby opening doors to services previously out of reach (Elinext, 2024; Finextra, 2024).

3.2. Income Smoothing and Cash Flow Management Tools

To combat income volatility, fintechs are offering innovative tools that help gig workers manage their unpredictable earnings and maintain stable cash flow.

- Earned Wage Access (EWA) Platforms: These platforms, like Paymenow in South Africa or Even and Steady in the US, allow workers to access a portion of their earned wages before their scheduled payday (Elinext, 2024; Finextra, 2024). This provides a crucial lifeline for managing immediate expenses and avoiding high-cost short-term debt. For fintech professionals, understanding the mechanics and regulatory considerations of EWA is key, as it represents a significant market opportunity.

- Smart Budgeting and Forecasting Apps: Several fintech apps are designed specifically for freelancers and gig workers. These tools often use AI to analyse past earnings patterns, predict future income, and help users create flexible budgets that adapt to their variable cash flow. They can also provide insights into spending habits and suggest ways to save more effectively.

3.3. Alternative Credit Scoring and Lending Platforms

Fintech lenders are revolutionising access to credit for gig workers by moving beyond traditional credit scoring methods.

- Utilising Non-Traditional Data: Instead of relying solely on credit bureau data, these platforms incorporate alternative data sources such as gig platform payment histories, bank account transaction data (often via Open Banking APIs), utility payment records, and even professional reputation on gig marketplaces (Finextra, 2024). This holistic approach provides a more accurate picture of a gig worker’s creditworthiness.

- Micro-Loans and Flexible Credit Products: Fintechs are offering microloans, lines of credit, and other flexible financing options tailored to the short-term needs and repayment capacities of gig workers. KarmaLife in India, for example, partners with SIDBI to provide instant lines of credit to blue-collar and gig workers through a mobile app, using gig platform data for assessment (Elinext, 2024).

3.4. Tailored Banking and Payment Solutions

Recognising that the banking needs of gig workers differ from those of traditional employees, fintechs are developing specialised banking products.

- Digital-Only Bank Accounts for Freelancers: Neobanks and fintech companies are launching bank accounts specifically designed for the self-employed. These accounts often come with features like integrated invoicing tools, automatic expense categorisation, tax savings pots, and seamless integration with gig platforms. Found is an example of a US-based freelancer-friendly business banking platform with tax tools (Finextra, 2024).

- Instant and Low-Cost Payment Solutions: Fintechs are streamlining the process of receiving payments for gig work, offering faster settlement times and lower transaction fees compared to traditional methods. The proliferation of real-time payment systems and digital wallets, particularly in markets like India with UPI, is a significant enabler.

3.5. Affordable Insurance and Benefits Platforms (Insurtech)

The benefits gap is a major concern for gig workers, and insurtech (insurance technology) companies are developing innovative solutions to address this.

- Micro-Insurance Products: These are affordable insurance products with low premiums and coverage tailored to specific risks faced by gig workers, such as health, accident, or income protection insurance. Turaco, operating in Uganda and Kenya, provides such microinsurance with monthly premiums around $2 (Elinext, 2024).

- Portable Benefits Platforms: Some fintechs are creating platforms that allow gig workers to access and manage a suite of benefits, including health insurance, retirement savings plans, and paid time off, that are portable across different gigs and platforms. Stride Health and Catch in the US offer affordable healthcare and retirement solutions (Finextra, 2024).

3.6. Automated Tax and Financial Administration Tools

To simplify the administrative burden of self-employment, fintechs offer tools that automate and streamline financial management and tax compliance.

- Expense Tracking and Invoice Generation: Many apps automatically track business expenses by linking to bank accounts or credit cards and allow for easy invoice creation and management.

- Automated Tax Calculation and Filing: Platforms like Keeper Tax and QuickBooks Self-Employed help gig workers identify tax-deductible expenses, estimate quarterly tax payments, and even facilitate electronic tax filing, reducing complexity and the risk of errors (Finextra, 2024).

By offering these targeted solutions, fintech companies are not just providing financial tools; they are empowering gig workers with greater control over their financial lives, fostering resilience, and enabling them to thrive in the flexible economy. For finance professionals, these developments signal a shift in how financial services are designed and delivered, with a greater emphasis on personalisation, data-driven insights, and platform-based ecosystems.

4. Fintech in Action: Case Studies and Success Stories (UK & India Focus)

The theoretical benefits of fintech for the gig economy come to life when examining specific companies and initiatives making a tangible difference in the UK and India. These markets, with their distinct characteristics and stages of gig economy development, offer valuable insights into how fintech solutions are being tailored and adopted.

4.1. UK Market Spotlight: Leveraging Open Banking and Addressing Worker Rights

The UK has a relatively mature gig economy and a sophisticated fintech ecosystem, further bolstered by progressive initiatives like Open Banking. This environment has fostered a range of fintech solutions aimed at supporting gig workers.

- Open Banking-Powered Solutions: The UK’s Open Banking framework has been a significant catalyst, enabling fintechs to access customer-consented bank account data. This allows for more accurate income verification for gig workers, facilitating access to credit and other financial products. Companies are leveraging this to offer personalised financial dashboards, budgeting tools, and even mortgage pre-qualification services for freelancers who can demonstrate consistent, albeit variable, income streams.

- Payment and Expense Management Platforms: Fintechs like Pleo and Soldo offer smart company cards and expense management solutions that, while often targeted at SMEs, are increasingly being adopted by or adapted for larger freelance communities and agencies that manage multiple gig workers. These platforms simplify expense tracking and reconciliation, a key pain point.

- Addressing Worker Benefits and Rights: Following landmark legal cases, such as the UK Supreme Court ruling on Uber drivers being classified as workers (StandOut CV, 2024), there’s a growing focus on providing benefits. Fintechs are partnering with gig platforms or offering direct-to-consumer solutions for pensions (e.g., PensionBee, Penfold) and flexible insurance products. For instance, Zego initially gained prominence by offering flexible, usage-based insurance for gig delivery drivers and riders, addressing a critical need for affordable and appropriate coverage.

- Challenges and Innovations: While the UK market is advanced, challenges remain, including ensuring genuine financial inclusion for the most vulnerable gig workers and navigating the evolving regulatory landscape concerning worker rights. Fintech innovation continues, with a focus on embedded finance within gig platforms and more sophisticated AI-driven financial advice.

4.2. India Market Spotlight: Leapfrogging with Digital Infrastructure and Financial Inclusion

India’s gig economy is characterised by its sheer scale and the rapid adoption of digital technologies, particularly mobile payments and digital identity infrastructure (Aadhaar and UPI).

- UPI-Driven Payment Solutions: The Unified Payments Interface (UPI) has revolutionised payments in India, and its impact on the gig economy is profound. Fintechs and gig platforms leverage UPI for instant, low-cost payouts to workers, significantly improving cash flow. This seamless payment infrastructure is a cornerstone of many fintech offerings for gig workers.

- Micro-Credit and Earned Wage Access (EWA): Given the large number of gig workers in India who may lack formal credit histories, fintechs focusing on micro-credit and EWA are crucial. KarmaLife, as previously mentioned, provides small-ticket, instant credit lines to gig workers by analysing their earnings data from partner platforms (Elinext, 2024). Other EWA platforms are emerging, allowing workers to access their earnings as they accrue, helping them manage daily expenses.

- Financial Literacy and Management Tools: With a significant portion of India’s gig workforce new to formal financial services, fintechs are also playing a role in enhancing financial literacy. Apps that offer budgeting advice, savings tools, and information on government social security schemes are gaining traction. The NITI Aayog report (2022) emphasised the need for financial literacy initiatives alongside access to financial products.

- Insurtech for the Masses: Similar to micro-credit, micro-insurance products are vital. Fintechs are partnering with insurance companies to offer affordable health, life, and accident insurance tailored to the needs and price points of gig workers, often distributed through gig platforms or mobile apps.

- Government Initiatives and Fintech Collaboration: The Indian government’s focus on financial inclusion (e.g., Pradhan Mantri Jan Dhan Yojana) and digitalisation (Digital India) creates a supportive environment. Fintechs often collaborate with government initiatives and public sector banks to extend their reach and impact.

4.3. Global Innovations with Relevance to UK/India

Beyond these specific market examples, several global fintech trends and company models hold relevance for both the UK and India:

- Platforms Specialising in Freelancer Financial Management: Companies like Found (US) or Coconut (UK) offer integrated banking, invoicing, expense management, and tax estimation specifically for self-employed individuals. Their success demonstrates the demand for all-in-one financial solutions.

- Portable Benefits Platforms: The concept of benefits that are tied to the individual rather than a specific employer is gaining global traction. Fintechs are exploring ways to create marketplaces or platforms where gig workers can access and manage a range of benefits (health, retirement, insurance) regardless of which platform they work for.

These case studies underscore the adaptability of fintech in addressing the diverse and evolving needs of the gig economy. By understanding the specific pain points and leveraging the unique technological and regulatory contexts of markets like the UK and India, fintechs are not just creating businesses but are also contributing to a more equitable and sustainable future of work.

5. Navigating the Landscape: Regulatory Considerations and Market Dynamics

The intersection of the gig economy and fintech, while ripe with opportunity, operates within a complex and evolving web of regulatory frameworks and market dynamics. For fintech and finance professionals, understanding this landscape in key markets like the UK and India is essential for sustainable innovation and compliance.

5.1. Regulatory Framework for the Gig Economy and Fintech (UK & India)

Governments and regulatory bodies worldwide are grappling with how to adapt existing laws or create new ones to address the unique aspects of the gig economy and the rapid advancements in fintech.

- United Kingdom:

- Worker Classification and Rights: A significant regulatory theme in the UK revolves around the employment status of gig workers. The landmark Supreme Court ruling in 2021, which classified Uber drivers as workers rather than self-employed contractors, has had far-reaching implications (StandOut CV, 2024). This decision entitles such workers to minimum wage, holiday pay, and pension contributions, creating both opportunities and compliance challenges for gig platforms and the fintechs that serve them. Fintech solutions for benefits administration and payroll for a “worker” status gig workforce are becoming increasingly relevant.

- FCA and Fintech Innovation: The Financial Conduct Authority (FCA) has generally adopted a pro-innovation stance, with initiatives like the regulatory sandbox and Project Innovate, which support fintech development. However, it also emphasises consumer protection. The Consumer Duty, introduced by the FCA, requires firms to act to deliver good outcomes for retail customers, including gig workers who use financial products. This has implications for how fintechs design, market, and support their offerings to this segment.

- Open Banking and Data Privacy: While Open Banking fosters innovation, data privacy regulations (like GDPR) must be strictly adhered to when handling gig worker data for credit scoring or personalised services.

- India:

- Social Security for Gig Workers: Recognising the vulnerability of gig workers, the Indian government introduced the Code on Social Security, 2020. This code aims to provide social security benefits (like health insurance, maternity benefits, disability insurance, and retirement benefits) to gig and platform workers. The operationalisation of these provisions is ongoing and presents a significant area for fintech involvement in benefits delivery and management (NITI Aayog, 2022).

- RBI Guidelines for Digital Lending: The Reserve Bank of India (RBI) has been actively regulating the digital lending space to curb predatory practices and protect borrowers. These guidelines impact fintechs offering credit to gig workers, covering aspects like transparency in loan terms, data privacy, and grievance redressal mechanisms.

- Data Protection (Digital Personal Data Protection Act, 2023): The DPDP Act provides a comprehensive framework for processing digital personal data. Fintech companies leveraging gig worker data must ensure compliance, particularly concerning consent, data minimisation, and security.

- Payment Systems Regulation: The RBI closely regulates payment systems, including UPI. While this ensures stability and interoperability, fintechs offering payment solutions must adhere to these evolving regulations.

5.2. Market Size and Growth Projections

As highlighted earlier, both the UK and Indian gig economies are substantial and poised for continued growth.

- UK: The gig economy contributes around £20 billion annually, with an estimated 1.7 million workers (StandOut CV, 2024). The demand for fintech solutions tailored to this segment is expected to grow in tandem, particularly in areas like flexible payments, benefits, and financial management tools.

- India: With a gig workforce projected to reach 23.5 million by 2029-30 (NITI Aayog, 2022) and a fintech market expected to reach $990 billion by 2032 (GlobeNewswire, 2025), the opportunity for fintechs serving the Indian gig economy is immense. The sheer volume of workers and the increasing digitalisation create a fertile ground for scalable fintech solutions.

5.3. Challenges and Opportunities for Fintechs in the Gig Economy Space

Despite the vast potential, fintechs operating in this space face several challenges:

- Diverse Needs: The gig economy is not monolithic. The financial needs of a freelance software developer differ significantly from those of a food delivery driver. Fintechs must develop targeted solutions or highly customizable platforms.

- Building Trust and Ensuring Data Security: Gig workers entrust fintechs with sensitive financial and personal data. Building trust through transparent practices and robust security measures is paramount.

- Scalability and Profitability: While the market is large, achieving scalability and profitability can be challenging, especially when dealing with low-margin, high-volume segments or the costs associated with customer acquisition and regulatory compliance.

- Navigating Regulatory Uncertainty: The regulatory landscape for both the gig economy and fintech is still evolving in many jurisdictions. Fintechs must remain agile and adaptable.

However, the opportunities are equally significant:

- Underserved Market: Traditional financial institutions have often overlooked or inadequately served gig workers, creating a substantial market gap for fintechs to fill.

- Data-Rich Environment: Gig platforms and digital transactions generate vast amounts of data that can be leveraged (with consent) to create highly personalised and effective financial solutions.

- Technological Advancements: Ongoing advancements in AI, ML, blockchain, and mobile technology continue to open up new possibilities for fintech innovation.

- Impact and Social Good: By providing financial tools and promoting inclusion, fintechs can have a significant positive impact on the lives and livelihoods of millions of gig workers.

6. The Future of Work and Finance: Trends Shaping Fintech for Gig Workers

The dynamic interplay between the gig economy and fintech is set to accelerate, driven by emerging technological trends and evolving worker expectations. Finance professionals and fintech innovators must keep a keen eye on these developments to anticipate the future needs of the flexible workforce.

6.1. Embedded Finance: Seamless Integration into Gig Platforms

One of the most significant trends is the rise of embedded finance. This involves integrating financial services, such as payments, lending, insurance, and banking, directly into the digital platforms that gig workers use daily (Fintech Strategy, 2025). Instead of seeking out separate financial apps, gig workers will increasingly access these services contextually within their work platforms. For example, a delivery platform might offer instant EWA, micro-insurance for a specific gig, or even savings tools directly within its app. This trend promises greater convenience, higher adoption rates, and more personalised offerings based on real-time work data.

6.2. AI and Big Data: Hyper-Personalisation and Proactive Support

Artificial Intelligence (AI) and Big Data analytics will continue to play a transformative role. Fintechs will leverage these technologies for:

- Hyper-Personalised Financial Advice: AI-powered robo-advisors can provide tailored financial planning, investment recommendations, and debt management strategies based on an individual gig worker’s income patterns, expenses, and financial goals.

- Enhanced Risk Assessment: More sophisticated AI algorithms will improve credit scoring for gig workers, leading to fairer and more accurate lending decisions.

- Proactive Financial Support: AI can anticipate potential financial shortfalls or opportunities for gig workers (e.g., upcoming tax deadlines, optimal times to save or invest) and provide timely alerts and guidance.

- Advanced Fraud Prevention: As digital transactions increase, AI will be crucial in detecting and preventing fraud, protecting both gig workers and platforms.

6.3. Decentralised Finance (DeFi) and Web3: Exploring New Paradigms

While still in its early stages of adoption for mainstream use cases, Decentralised Finance (DeFi) and Web3 technologies hold potential for the gig economy. Areas to watch include:

- Decentralised Identity: Web3 solutions could give gig workers greater control over their professional identity and credentials, making it easier to port their reputation and work history across different platforms.

- Crypto Payments and Stablecoins: For cross-border gig work, cryptocurrencies and stablecoins could offer faster and cheaper payment solutions, though regulatory clarity is still needed.

- DAOs for Gig Worker Collectives: Decentralised Autonomous Organisations (DAOs) could potentially enable new forms of collective bargaining or benefit pooling for gig workers, although this is a more speculative long-term prospect.

6.4. Greater Emphasis on Financial Wellness and Literacy

There is a growing recognition that providing access to financial products is not enough; empowering gig workers also requires enhancing their financial literacy and overall financial wellness. Fintechs are increasingly incorporating educational resources, financial coaching tools, and features that encourage healthy financial habits (e.g., automated savings, debt management plans) into their platforms. This holistic approach aims to build long-term financial resilience for gig workers.

6.5. Evolving Regulatory Landscapes and Worker Protections

The regulatory environment will continue to adapt to the realities of the gig economy. We can anticipate:

- Clearer Definitions of Worker Status: More jurisdictions may follow the UK’s lead in clarifying the employment status and rights of gig workers, leading to new requirements for benefits and protections.

- Data Portability and Open Finance: Building on Open Banking, Open Finance initiatives could give gig workers even greater control over their financial data, enabling them to share it securely with a wider range of service providers to access better products.

- Focus on Ethical AI and Algorithmic Transparency: As AI becomes more prevalent in financial decision-making for gig workers, regulators will likely increase scrutiny on algorithmic bias and transparency.

These trends suggest a future where fintech solutions for gig workers are more integrated, intelligent, personalised, and focused on holistic financial well-being, all within a continuously evolving regulatory framework.

7. Conclusion: Empowering the Gig Economy through Fintech Innovation

The rise of the gig economy represents a fundamental transformation in how work is structured and performed, offering unprecedented flexibility but also presenting unique financial challenges for millions globally. Traditional financial systems, often designed for a world of stable, long-term employment, have struggled to keep pace. Into this gap has stepped the dynamic and innovative fintech sector, armed with technology, data, and a fresh perspective on financial services.

7.1. Recap of Fintech’s Transformative Impact

As this article has explored, fintech is making a profound impact on the financial lives of gig workers in the UK, India, and beyond. From providing Earned Wage Access and alternative credit scoring to offering tailored banking solutions, micro-insurance, and automated tax tools, fintech innovations are directly addressing the pain points of income volatility, financial exclusion, the benefits gap, and administrative complexity. By leveraging mobile technology, AI, and alternative data, fintechs are creating more inclusive, accessible, and user-centric financial products that empower gig workers to manage their finances more effectively, build resilience, and achieve their financial goals.

7.2. The Path Forward: Collaboration and Continuous Adaptation

The journey of integrating fintech into the gig economy is ongoing. The path forward will require continued innovation from fintech companies, greater collaboration between fintechs, gig platforms, traditional financial institutions, and policymakers. Gig platforms have a crucial role to play in facilitating access to fintech solutions for their workers, potentially through embedded finance offerings. Policymakers and regulators must continue to adapt frameworks to protect gig workers while fostering a competitive and innovative fintech landscape. A multi-stakeholder approach is essential to ensure that the benefits of fintech are widely accessible and that the evolving needs of the gig workforce are met.

7.3. Final Thought: A More Inclusive Financial Future for the Flexible Workforce

The gig economy is not a fleeting trend but a structural feature of the modern labour market. As it continues to grow and evolve, so too will the financial needs of its participants. Fintech innovation, driven by a commitment to solving real-world problems and a deep understanding of the gig worker’s experience, holds the key to unlocking a more inclusive, secure, and empowering financial future for this vital and flexible segment of the global workforce. For finance professionals and fintech leaders, the opportunity to shape this future is immense, promising not only commercial success but also a significant positive social impact.

References

- Berkeley Payment Solutions. (2025). Navigating Payment Solutions in the Gig Economy. Retrieved from [Insert actual URL if found, placeholder for now]

- Elinext. (2024, August 29). Fintech Solutions for Gig Workers: The Apps They Really Want. Retrieved from https://www.elinext.com/industries/financial/trends/fintech-solutions-for-gig-workers/

- Finextra. (2024, November 27) . Addressing Financial Gaps in the Gig Economy: Fintech Solutions Empowering Gig Workers. Retrieved from https://www.finextra.com/blogposting/27320/addressing-financial-gaps-in-the-gig-economy-fintech-solutions-empowering-gig-workers

- Fintech Strategy. (2025, February 10) . Embedded Finance: Meeting the needs of the gig economy. Retrieved from https://www.fintechstrategy.com/blog/2025/02/10/embedded-finance-meeting-the-needs-of-the-gig-economy/

- GlobeNewswire. (2025, May 9) . India’s Fintech Market to Reach $990 Billion by 2032 at 30.2% CAGR. Retrieved from https://www.globenewswire.com/news-release/2025/05/09/3077984/0/en/India-s-Fintech-Market-to-Reach-990-Billion-by-2032-at-30-2-CAGR-Fintech-Firms-Eye-Untapped-Indian-Digital-Payments-Market-with-Secure-Low-Cost-Digital-Financial-Solutions.html

- NITI Aayog. (2022, June) . India’s Booming Gig and Platform Economy: Perspectives and Recommendations on the Future of Work. Retrieved from https://www.niti.gov.in/sites/default/files/2023-06/Policy_Brief_India%27s_Booming_Gig_and_Platform_Economy_27062022.pdf

- StandOut CV. (2024). Gig Economy Statistics UK | 2024 Industry Report. Retrieved from https://standout-cv.com/stats/gig-economy-statistics-uk